Over the last few weeks the team at Videosign have been talking to customers about their ID verification needs. We support customers across a wide range of industries. Each has their own legal and policy requirements, and their own priorities when it comes to balancing security with customer experience internally and externally. However, the consistency of messaging is clear when it comes to ID verification: trust is crucial.

So how do you choose the right ID verification method for your unique scenario?

Let’s delve into the exciting world of identity verification!

Knowledge-Based Authentication (KBA): Think “security questions.” This method tests users against pre-defined personal details like previous addresses or childhood schools. While convenient, its effectiveness hinges on the questions’ obscurity and vulnerability to social engineering. KBA might be suitable for low-risk interactions like initial account creation but shouldn’t be the sole verification layer. Think of it as the first line of defence, good for initial account creation, but not the ultimate guardian.

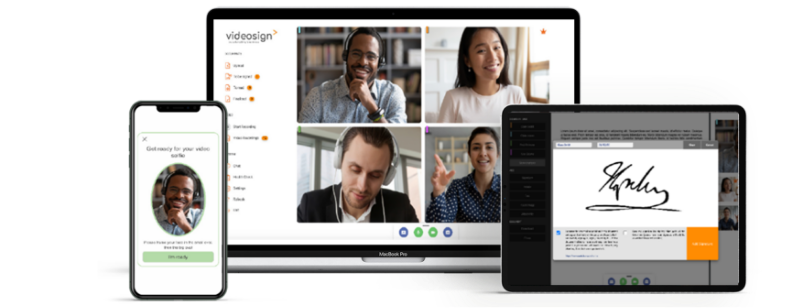

Document Verification: This involves checking government-issued IDs like passports or driver’s licenses. For a lot of transactions, this level of ID verification is more than sufficient. Customers use Videosign to verify identity on-screen whilst meeting remotely. The difference between Videosign and other video conferencing platforms is that Videosign records it, timestamps it, stitches together live captured videos of all participants into one single piece of video evidence and embeds this into the document audit.

Automated systems can check document validity and extract data. While effective, it relies on document authenticity and doesn’t prove the person submitting it is the rightful owner.

Two-Factor Authentication (2FA): Adding a second layer of verification, like a code sent to a linked phone or email, enhances security. Think of it like adding a secret handshake to your password. It can help to prevent unauthorised access even if someone acquires login credentials. 2FA is becoming a requirement across sectors for access to sensitive data.

Biometric Verification: Facial recognition, fingerprints, or voice recognition offer high security but raise privacy concerns. While not currently mainstream, advancements in technology and user acceptance may make biometrics a future contender. Videosign partners with Jumio to offer biometric verification that meets ‘Know Your Customer’ (KYC) and ‘Anti-Money Laundering’ (AML) regulatory compliance.

Now, for the plot twist: Bank Account Verification! This method involves securely verifying a user’s ID via a connected bank account. With the user’s consent, the ID check retrieves real-time data like name and account number, directly comparing it to information held by the bank. It’s like having a personal bank manager vouching for the user, offering a convenient and highly secure option for transactions where financial details are involved.

Videosign is integrating with One ID to offer bank ID verification to our customers. One ID is now fully certified for KYC and AML checks and processes.

Choosing the Right Tool for the Job:

How do you match the verification method to the scenario?

- Estate agents: For tenancy applications or low-value agreements, KBA and document verification is most likely to suffice when integrated with the required right to rent checks.

- Wealth management: Considering the sensitivity of financial data, 2FA is mandatory. Document verification and even biometrics, once regulations and user concerns are addressed, could provide additional layers assurance.

- Training Providers: The type of ID verification required by training providers for verifying their students’ IDs will depend on factors such as regulatory compliance requirements, and the platform used by the provider. In most cases, document verification is most likely to meet a provider’s requirements and with a shift to distance and online learning, a video audit trail of these checks will support audit trails.

- Human Resources: Again in most scenarios, document verification will be sufficient. Where specialist checks are required (e.g., background checks), then third-party verification services that specialise in confirming the authenticity of identity documents can be used for additional assurances.

Remember, the best security is a well-rounded team! The ideal approach balances security with user experience. Consider the risk level, industry regulations, and user comfort when choosing your verification methods. By offering a flexible and secure solution, Videosign is a trusted guardian for businesses across industries, empowering them to navigate the digital landscape with confidence.

Additional Considerations:

- Compliance: Stay updated on industry regulations and data privacy laws like GDPR to ensure your chosen methods comply.

- Integration: Ensure your chosen verification system integrates seamlessly with your eSignature platform for a smooth user experience.

- User Education: Inform clients about the different verification methods and their implications to build trust and transparency.

To find out how Videosign can support ID verification processes as part of our contract management processes, contact the team on enquiries@videosign.co.uk or sign up for a free trial.