In today’s digital age, we know wealth management advisors are constantly seeking ways to streamline their processes, enhance client experiences, and improve operational efficiency. One invaluable tool that has revolutionised the financial services industry is electronic signatures (e-signatures) and online contracting software. These technologies have not only simplified the administrative aspects of the wealth management profession but also significantly contributed to improving security and compliance.

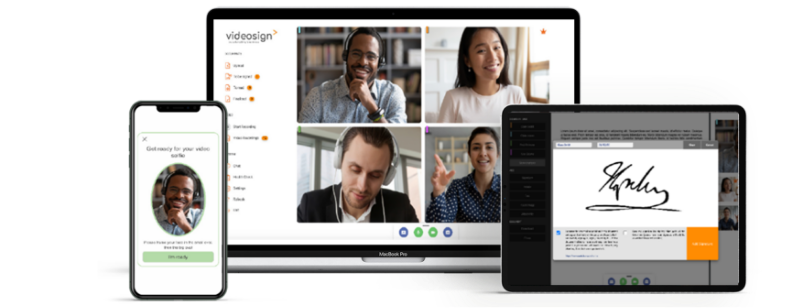

In support of World Financial Planning Day, Nina Hinton, Head of Business Growth at Videosign, explores the numerous advantages of incorporating e-signature and online contracting software into financial planning and wealth management practices.

Enhanced Efficiency

E-signature and online contracting software offer wealth management advisors a means to significantly expedite the client onboarding and contract execution process. Gone are the days of mailing, scanning, or faxing lengthy paper documents, a process that often took days or even weeks to complete. With electronic signatures, advisors can send contracts to clients with just a few clicks, allowing for swift reviews and approvals. This not only saves time but also enhances the overall client experience, making it more convenient and efficient.

Improved Client Experience

Clients today expect a seamless and convenient experience when dealing with their financial advisors. Online contracting software align perfectly with these expectations by enabling clients to sign documents from the comfort of their homes or on-the-go. This convenience not only fosters trust and satisfaction but also demonstrates the advisor’s commitment to providing modern, client-centric solutions.

Reduced Error Rates

Manual data entry is prone to errors that can be costly in the wealth management industry. E-signature and online contracting software eliminate the need for manual data transfer from paper documents, reducing the likelihood of data entry errors. This not only saves time but also minimises the potential for compliance issues or financial discrepancies.

Enhanced Security

Data security is paramount in the financial services industry, where sensitive client information is regularly handled. E-signature and online contracting software provide robust security features such as encryption, identity checks, and audit trails. These features ensure that documents are protected against unauthorised access and tampering, meeting the strict security requirements of regulatory bodies.

Compliance and Recordkeeping

Wealth management advisors operate in a highly regulated environment with stringent compliance requirements. E-signature and online contracting software help advisors maintain compliance by providing a digital trail of document execution, complete with timestamps and authentication records. This makes it easier for advisors to demonstrate compliance to auditors and regulators.

Cost Savings

Using e-signature and online contracting software reduces paper and printing costs, courier fees, and storage expenses associated with physical document management. Additionally, the time saved on administrative tasks can be allocated to revenue-generating activities, ultimately contributing to cost savings and increased profitability.

Scalability

As wealth management practices grow, the demand for administrative work can become overwhelming. E-signature and online contracting software can scale with the business, accommodating a larger volume of clients and transactions without a proportional increase in administrative overhead.

Eco-Friendly Practices

Adopting electronic signatures and online contracting aligns with sustainability goals by reducing paper consumption and environmental impact. Wealth management advisors can proudly communicate their commitment to eco-friendly practices to clients who prioritize environmentally responsible businesses.

The adoption of e-signature and online contracting software has become a game-changer for wealth management advisors. By streamlining processes, improving efficiency, enhancing security, and ensuring compliance, these technologies empower advisors to provide superior services to their clients while reducing operational costs. Embracing these tools not only keeps wealth management practices competitive but also demonstrates a commitment to innovation and client satisfaction in the digital era. In the evolving landscape of wealth management, e-signature and online contracting software are more than just conveniences; they are indispensable tools for success.