The Digital Operational Resilience Act (DORA) is now officially in effect, marking a significant milestone for the financial sector. Designed to strengthen the industry’s ability to withstand digital disruptions, DORA is a crucial regulation that impacts banks, wealth management firms, and fintech companies alike. Its aim? To ensure financial entities and their service providers can continue operating smoothly, even in the face of cyber threats or technical failures.

As organisations work to align with this new regulation, Videosign is here to help.

What is DORA?

In simple terms, DORA sets out to ensure that the financial sector’s digital infrastructure is robust, secure, and resilient. This means financial institutions must have systems and processes in place to:

- Detect, prevent, and respond to cyber attacks.

- Ensure minimal downtime during digital disruptions.

- Maintain compliance with stringent operational standards.

DORA doesn’t just apply to financial institutions—it also extends to third-party service providers, including technology vendors. If you’re using digital tools for operations or client engagement, they need to meet the same high standards.

For detailed guidance on enhancing cyber security in your organisation, you may want to consult the National Cyber Security Centre (NCSC).

Why Does DORA Matter to Your Business?

DORA’s introduction highlights the increasing risks posed by the digital age. From cyber attacks to system failures, the financial sector is under constant pressure to maintain secure and seamless operations. Non-compliance is not an option—it comes with the potential for hefty fines and reputational damage.

To adapt, businesses must scrutinise their digital tools and vendors. Are they secure? Reliable? Compliant? This is where Videosign stands out as a valuable partner.

How Videosign Aligns with DORA’s Goals

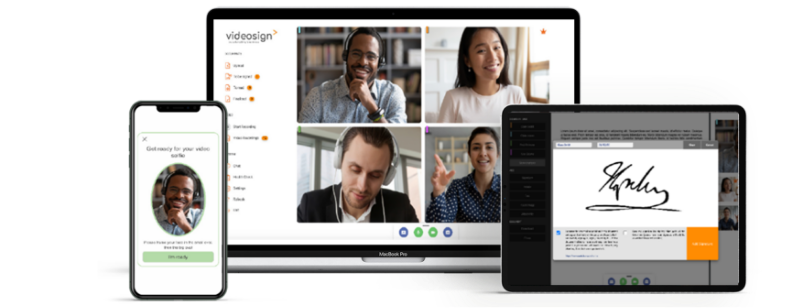

Videosign is more than just a digital signature platform—it’s a secure, reliable, and compliant solution designed to meet the needs of modern businesses. Here’s how it aligns with DORA’s key objectives:

- Advanced Security

Videosign prioritises the security of your operations. With features like encrypted document sharing, secure video meetings, and built-in ID verification, our platform ensures your data and transactions are protected from potential threats.

- Reliability and Continuity

Digital resilience is at the heart of DORA, and Videosign delivers. Our platform is designed for seamless, reliable performance, ensuring business continuity.

- Simplified Compliance

Navigating compliance can be complex, but Videosign makes it easier. Our robust compliance features are tailored to meet the needs of regulated industries like wealth management and legal services, ensuring you stay ahead of evolving regulations.

How to Prepare for DORA Compliance

Adapting to DORA doesn’t have to be overwhelming. Here are some practical steps:

- Assess Your Digital Tools

Review the technology you use for day-to-day operations. Are they secure and reliable?

- Choose Trusted Vendors

Partner with providers like Videosign, who prioritise security, compliance, and operational resilience.

- Regularly Review Processes

Stay proactive by evaluating your processes and adapting to new regulatory requirements.

Future-Proof Your Operations with Videosign

As DORA reshapes the financial sector, businesses need to prioritise resilience and compliance. Videosign offers a solution that not only supports these goals but also simplifies your workflows, enhances security, and saves time.

If you’re ready to take the next step, we’d love to show you how Videosign can support your business.

Schedule your free demo with our team today!