Two high-profile stories in the news recently highlight how using Videosign could have prevented fraud worth more than $31m.

That’s not a typo. Just two preventable fraudulent transactions among the thousands that take place every day cost enough money to buy an island paradise or a small fleet of private jets.

First up was an incident in Hong Kong, where a finance worker was tricked into transferring $25m to criminals who used deepfake technology to pose as the company’s chief financial officer and various other colleagues during a video call.

The worker had initially been suspicious after being contacted by email to request the transaction, but was convinced to send the money after recognising the faces and voices of people on the call – all of whom were digitally faked.

The second story involves a much less sophisticated form of fraud, but one that many organisations remain vulnerable to.

Investigations continue after the forged signature of former Nigerian president Muhammadu Buhari was allegedly used to illegally transfer more than $6m from the country’s central bank.

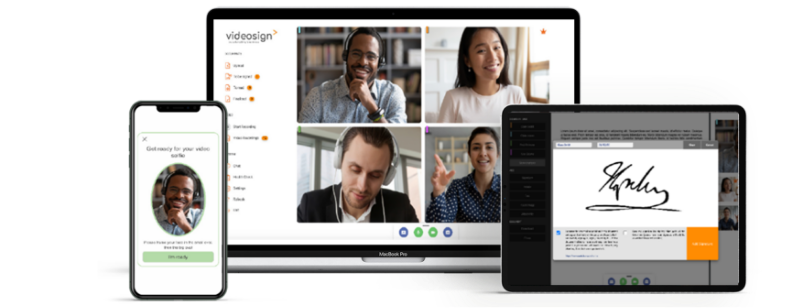

Both of these incidents could have been avoided if the organisations involved were in the routine of using Videosign’s meeting software to sign and witness documents.

How? Let’s tackle the most simple one first.

Although the pen-and-ink signature has been with us for centuries, it has always been vulnerable to fraud.

Where traditional signatures are still in use, we recommend using Videosign – with the layers of fraud protection our unique software offers – to record visual evidence of the signature being made.

The additional evidence we collect, including video and various forms of metadata, mean we can offer extra assurance and protection to organisations still working with pen and paper.

Our technology also uses biometric data to verify the identity of users prior to signing. These security measures could have saved the Central Bank of Nigeria from falling victim to one of the simplest forms of fraud.

But what about the use of deepfakes, like the incident in Hong Kong?

Videosign is ahead of the game in this area too, with the power to spot deepfake technology and prevent even the most sophisticated scam attempts.

Certified ‘liveness detection’ measures integrated into our software can check that the person you’re dealing with is real by monitoring physiological or behavioural characteristics and confirming whether the face on screen is genuinely three-dimensional or just a two dimensional digital fake.

What can you do?

Our advice to any organisation, and especially those routinely moving large sums of money, is simple:

- Stop using pen-and-ink signatures if you can

- Remain vigilant for criminals using emerging technology to commit fraud

- Start using Videosign for its efficient user experience and heightened security options

Want to know more? Contact us to find out how Videosign can help to protect your organisation from falling victim to fraud.